Our Services

Trusted Premier Wealth Management

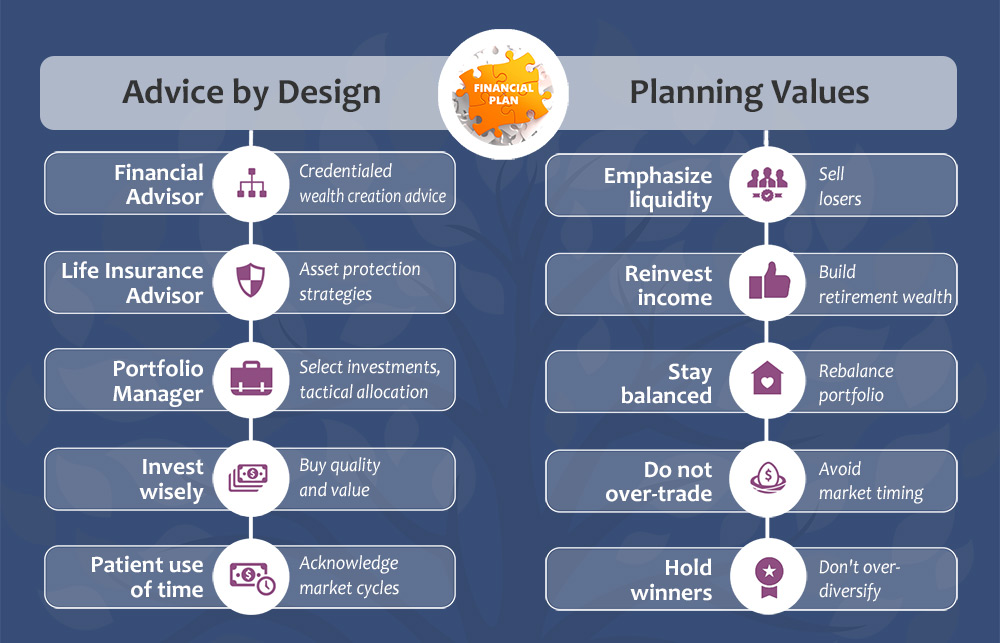

We can recommend the best strategies with investment products with excellent track records to meet your planning objectives. Additionally, we can help you organize your retirement, estate planning affairs, identify your objectives, and assist you in your planning needs.

Financial Independence to Retire Early.

Our holistic wealth management service is delivered via our “FIRE POWER” program! We employ planning values and develop a Plan, to give you an Overview of the situation. You’ll know What needs to be addressed to Execute solutions. And through Regular monitoring, you will build your “FIRE.”

The distinguishing characteristic of the Canadian Wealth Management landscape is that consumers are not all the same. Therefore, a one-size-fits-all strategy has never worked and will never work. Over the last century, CANFIN Wealth Management has developed our proprietary and in-depth expertise for each client segment. This landscape contains a wide range of diverse and demanding clientele with unique characteristics, such as their:

- Personal wealth profiles (Income, Net-Worth, Occupation)

- Wants and needs (lifestyle and financial)

- When and How they’re approached, and

- Different Pricing structure (Individual, High Net-Worth, Family Office – Knowledge & Expertise)

Since inception, our vision has been unwavering in an ever-changing world: to be the Premier wealth management advisory firm in the communities we choose to serve! To fulfill this vision, we execute on our mission: “Through knowledgeable, trusted, and professional advisors, we offer comprehensive advice, quality products, and outstanding services.”

We are committed to delivering significant value to our clientele in their wealth-building journey, regardless of what stage they are presently at!

Financial Strategies Managed

Your Dreams are Unique.

Everyone’s dreams, needs and financial situations are different. The level of financial planning services and related products you may need from CANFIN WEALTH will also be unique.

Real Estate Services: Commercial and Residential

Tax Management & Estate Management

Individual & Family Wealth Services & Investment Management

Business and Personal Insurance

Insurance needs: Life, Disability, CI, Health and Travel

Business and Professional Wealth Management Products and Services

Business and Management Consultation

Residential & Commercial Mortgages

Private Wealth Services for the Affluent and Family Wealth

Solutions

Comprehensive & Integrated Financial Planning Solutions

Wealth Creation

Investment Management solutions.

Wealth Preservation

Risk Management including various life Insurance, Disability and Critical Illness, Long term care and supplemental health insurance packages, Auto, Home and business insurance services.

Wealth Distribution Management

Various Planning and Advisory Services strategies to manage and distribute wealth

Investment Principles

We believe that every investor should adhere to these six common investment principles

- Invest for the long term

- Invest with patience

- Don’t time the markets

- Don’t worry about shifts in the economy and markets

- Avoid predictions

- Don’t chase the latest fad which sounds too good to be true, very often they are